1. Introduction

Japan’s startup ecosystem has rapidly evolved, with Tokyo entering the global top 10 in 2024—a major milestone. This growth is driven by government support, rising venture capital (VC) investment, and university-led deep-tech startups. Key sectors like manufacturing and life sciences are expanding globally, with Tokyo recording 11 large exits ($50M+) in 2023, second only to Silicon Valley and Tel Aviv.

However, the scope for further improvement remains, particularly in encouraging late-stage funding, promoting foreign investment, and further developing the M&A market. fo

This article will analyze the latest trends in Japan’s startup market, highlight key success stories, explore government initiatives, and examine the challenges and solutions needed for further growth.

2. The Current State of Startup Investment in Japan

2.1 Growth of Startup Investment

Japan’s startup investment landscape has expanded significantly over the past decade. Total startup investment has grown from ¥877 billion in 2013 to ¥8.77 trillion in 2022, demonstrating strong momentum despite global economic slowdowns.

This resilience can be attributed to a combination of government support, increased corporate venture capital (CVC) activity, and a growing innovation ecosystem driven by universities and research institutions.

METI: Japan Startup Ecosystem June2024

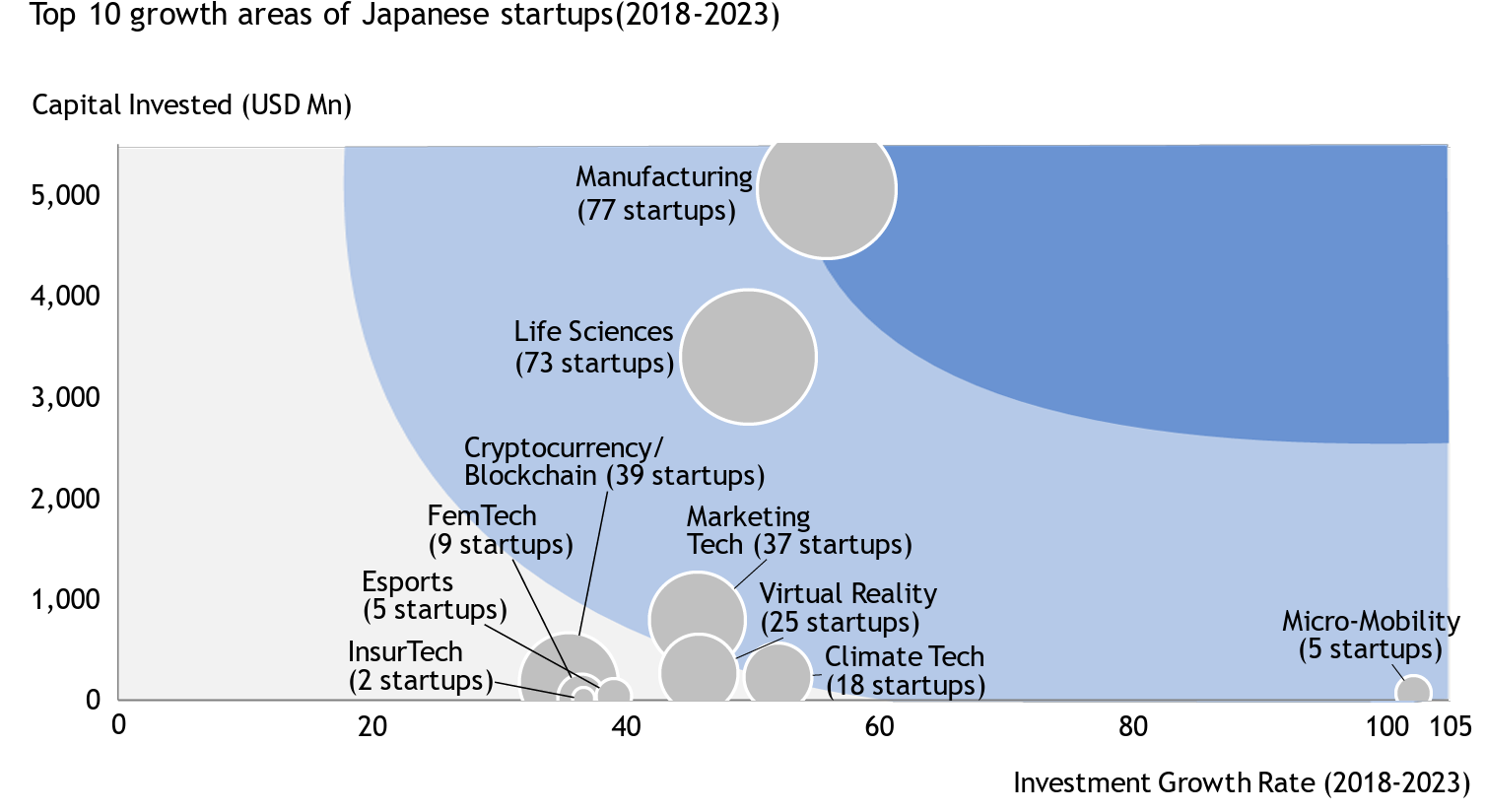

Several key sectors have emerged as dominant players in Japan’s startup ecosystem:

- Manufacturing: Innovations leveraging advanced technologies such as robotics, automation, and AI-driven industrial processes. The most active sub-sectors include:

- Automobile/Storage Battery

- Shipping

- Aircraft

- Semiconductor/Information & Communication

- Life Sciences: Growth in biotechnology, pharmaceuticals, and AI-driven healthcare solutions.

- Climate Tech: The push for decarbonization and renewable energy solutions, supported by government incentives and corporate investment. The four leading sub-sectors include:

- Offshore Wind, Solar, Geothermal

- Hydrogen, Fuel Ammonia

- Carbon Recycle

- Resource Recycling

These sectors reflect Japan’s strategic focus on high-tech, industrial innovation, and sustainability, positioning the country as a key player in deep-tech and advanced manufacturing.

METI: Japan Startup Ecosystem June2024

2.2 International Comparison

Despite strong growth in startup investment, Japan still lags behind leading global markets in key areas.

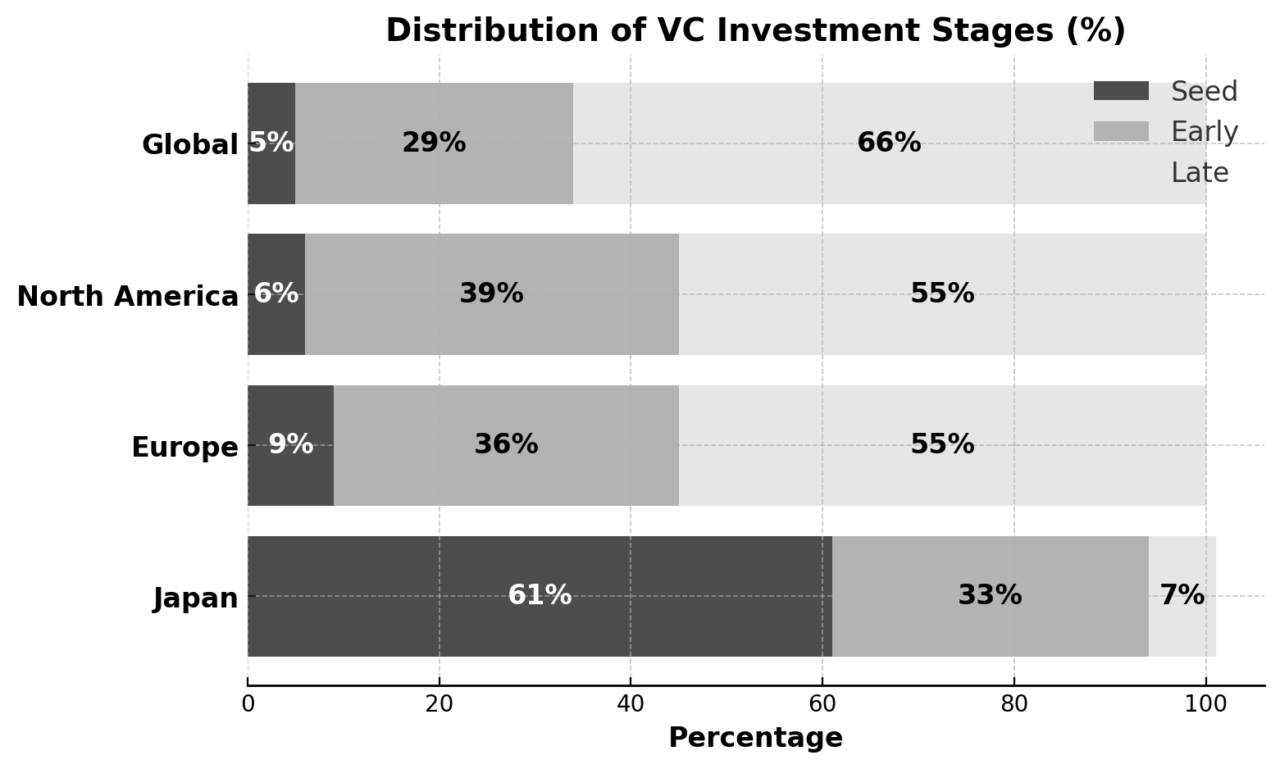

One key area for growth in Japan’s startup ecosystem is increasing venture capital (VC) investment intensity. Currently, VC investment accounts for 0.08% of GDP, presenting a significant opportunity for expansion when compared to the U.S. (0.64%) and China (0.23%). Additionally, foreign investment in Japanese startups stands at 11%, leaving room for growth toward levels seen in the U.S. and Europe (40–50%). Strengthening policies and initiatives to attract both domestic and international investors will be a significant impetus to augment the country’s startup ecosystem.

3. Challenges Facing Japan’s Startup Ecosystem

Despite its technological strengths, Japan’s startup ecosystem still faces challenges in scaling high-growth startups. Currently, Japan has 11 unicorns, far fewer than major startup hubs like the U.S. and China. Programs like Plug and Play Japan, Open Network Lab, and Samurai Incubate have yet to achieve a global-scale impact. Therefore, there is an opportunity for startup ecosystem partners to collaborate with governments across all levels of administration to promote policies that encourage the creation of additional unicorn companies.

Improving the capabilities of accelerator programs will also serve as an effective catalyst to attain this objective. On the investment side, further efforts need to be undertaken to promote funding in late-stage companies and promote the country’s innovative potential to overseas VC investors.

3.1 Opportunities in Early-Stage Funding

Japan’s startup ecosystem presents strong opportunities for early-stage investment, with 61% of VC funding concentrated in Seed and Series A rounds. While only 7% of VC investment currently goes to late-stage funding—compared to 33% in Europe and 55% in North America—this creates a favorable environment for investors looking to support startups in their initial growth phases. By focusing on early-stage funding, investors can play a crucial role in nurturing high-potential startups and positioning them for long-term success.

WORLD BANK GROUP: Tokyo startup ecosystem

3.2 Untapped Opportunities for Foreign VC Investment & Global Growth

Japan’s startup ecosystem presents a significant opportunity for international investors, as foreign VC participation remains 38% lower than in global markets. Unlike highly competitive startup hubs such as Singapore, the U.S., and France, Japan offers access to high-quality startups with relatively lower valuations and ticket sizes.

This lower saturation rate provides international investors with a unique chance to enter the market early and support promising startups with strong growth potential. In this manner, the degree of risk inherent in startup investments are mitigated to a considerable extent. Increasing global engagement could also help Japanese startups scale internationally, unlocking further value for both investors and founders.

4. Government Startup Support Policies

4.1 The Startup Development Five-Year Plan

Launched in November 2022, Japan’s Startup Development Five-Year Plan aims to position the country as a global startup hub. Key goals include ¥10 trillion ($72.4B) in startup investment by 2027, 100 unicorns, and 100,000 startups.

Key Initiatives:

- Talent & Networks: J-Startup Program (funding & networking), J-StarX (global mentorship), and expanded Startup Visa (up to 2 years).

- Funding & Exits: Public-private VC, stock option tax reforms, and open innovation tax incentives.

- Global Expansion: Deep Tech grants (¥3B per startup), Japan Innovation Campus (Silicon Valley hub), and JETRO’s Global Acceleration Hubs in 30 cities.

The government is also enhancing M&A incentives and secondary markets to diversify exit strategies.

METI: Startup Development Five-year Plan

5. Conclusion: Unlocking Japan’s Potential Through Early-Stage Investment

Japan’s startup ecosystem has grown rapidly, driven by government support and increasing venture capital. To sustain this momentum, strengthening seed and early-stage investment is key. With 61% of VC funding in Seed and Series A rounds, Japan offers attractive opportunities for investors seeking high-potential startups at lower valuations.

Boosting late-stage funding, expanding exit options, and increasing foreign investment will further accelerate growth. By fostering early-stage innovation and collaboration, Japan can solidify its position as a leading global startup hub.

About EXPACT

EXPACT provides a variety of operational support to domestic and international startups.

EXPACT offers market entry strategy advisory for international businesses looking to establish a presence in Japan. Our services are as follows:

– Advice for visas and programs: Providing guidance on suitable visas and government programs for foreign entrepreneurs (e.g., Startup visa).

– Market research assistance: Evaluating the potential market size and demand for the product or service.

– Geographical evaluation based on the company’s target: Carrying out a location analysis to determine the most suitable region, prefecture, and city according to the startup’s specific needs.

– Support for applying for financial aid programs: Sourcing and supporting the application process for applicable government grants and subsidies.

– Assistance for forming partnerships: Serving as a liaison to help the startup establish connections with local partners, investors, and government institutions.

– Advice for a business plan: Offering a business plan review with insights from a Japanese perspective.

– Translation services: Providing translation services for in-person meetings, virtual discussions, and document preparation.

For assistance or additional information, please contact us at info@expact.jp for inquiries.

Inquiries on market entry strategies can be directed to pramod@expact.jp

References

The Global Startup Ecosystem Report 2024

Japan’s Startup Visa: A Guide for Foreign Entrepreneurs

Startup Development Five-year Plan

Roadmap for the Startup Development Five-Year Plan